Connecticut United Ways

2024 ALICE Policy Agenda

Action One

Create a permanent, fully refundable Connecticut child tax credit (CTC).

The situation is urgent. Since 2021, the ALICE Essentials Index shows 18% inflation in the cost of household basics. This blow is combined with the loss of pandemic-era federal benefits that supported ALICE families.

A 100% refundable credit means that families who do not have a tax liability would receive the full value of the credit.

Eligibility: up to $100,000 annual income for a single filer, $200,000 for joint filers.

Estimated cost of a child tax credit of $600 per child up to three children: $300 million per year (individual family benefits and total policy cost depend on income phaseout schedule).

Action Two

Continue free, healthy school breakfasts for all Connecticut students and leverage federal funds to expand no-cost school meals.

Our kids should have what they need to learn. Providing students with adequate nutrition is essential for success in school, just like school buses, textbooks and technology.

- Annualize the $16 million allocated in the 2023/24 school year to provide no-cost school breakfast for all Connecticut students in participating districts.

- Leverage federal funds to cover most of the cost to expand no-cost school meals — state funds fill only the gap between federal reimbursement and actual costs.

Action Three

Invest in 24/7/365 access to more than 40,000 basic needs resources for Connecticut residents.

Steep increases in prices, increased levels of need: people are turning to 211 for help more than ever.

211 is a “force multiplier” maximizing public and private basic needs supports available right now for Connecticut residents.

An additional $1.25 million in new funding would allow 211 I&R to:

- Serve more residents to meet current demand

- Decrease hold times

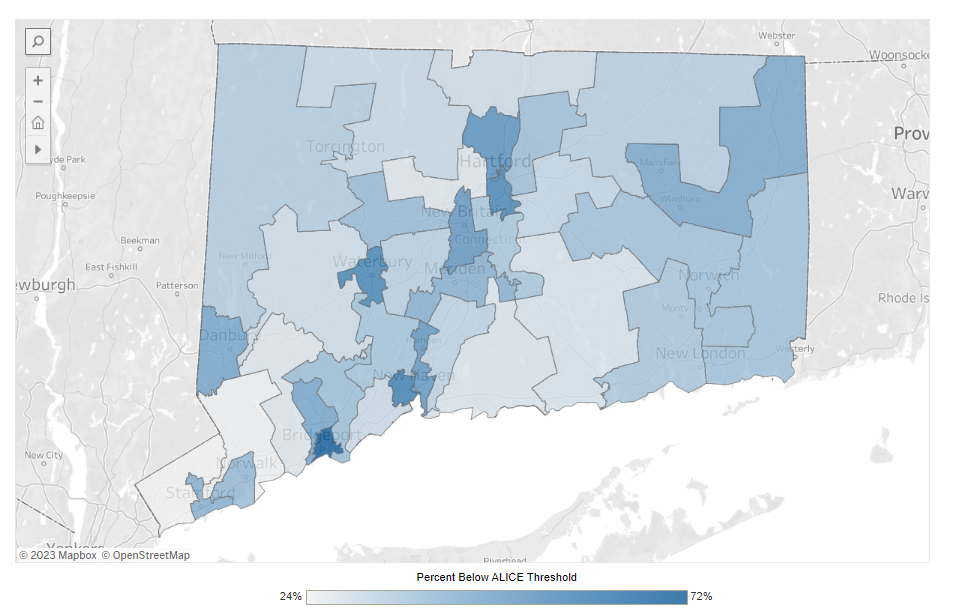

Alice Legislative District Tool

This interactive tool helps policymakers and community stakeholders better understand how many households are actually struggling in their district.